working capital turnover ratio ideal

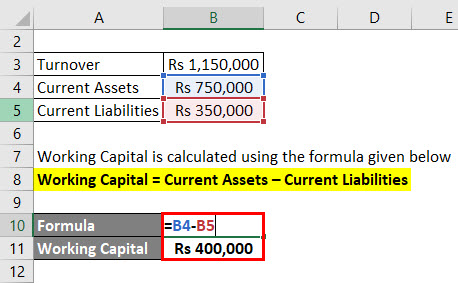

Calculating Working Capital Turnover Ratio provides a clear indication of how hard you are putting your available capital to work in order to help your company succeed. Working Capital Current Assets - Current Liabilities.

How To Calculate Working Capital Turnover Ratio Flow Capital

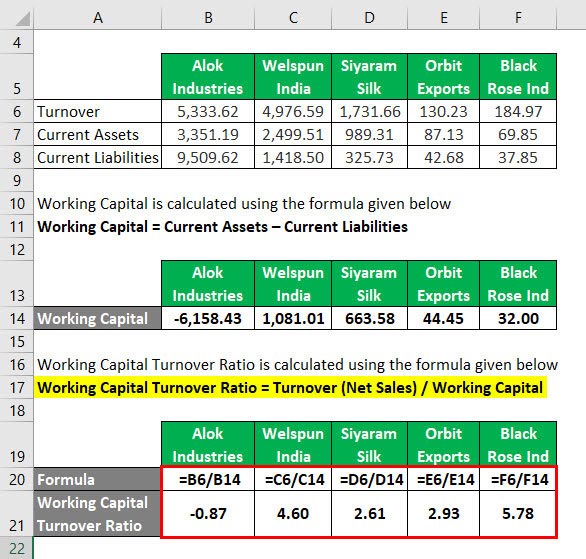

In this formula the working capital is calculated by subtracting a companys current liabilities from its current assets.

. Working capital can be calculated by subtracting the current assets from the current liabilities like so. Ideally the higher the working capital turnover ratio of the business is the better it is considered. Hence the Working Capital Turnover ratio is 288 times which means that for every sale of the unit 288 Working Capital is utilized for the period.

This concludes our article on the topic of Working Capital Turnover Ratio which is an important topic in Class 12 Accountancy for Commerce students. Working Capital Turnover Ratio 288. The working capital turnover ratio is thus 12000000 2000000 60.

A high turnover ratio indicates that management is being extremely efficient in using a firms short-term assets and liabilities to. This means that every dollar of working capital produces. Higher the capital turnover ratio better will be the situation.

Working capital turnover ratio examples. This company has a working capital turnover ratio of 2. The average working capital during that period was 2 million.

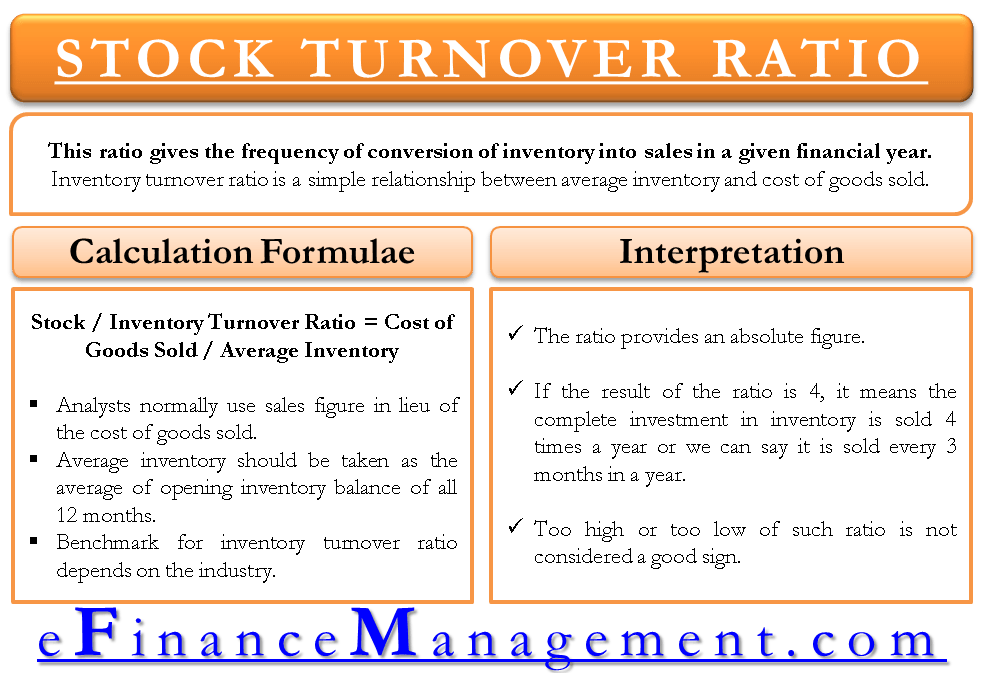

The more sales you bring in per dollar of working capital deployed the better. Working capital as usual is the excess of current assets over current liabilities. Net annual sales divided by the average amount of working capital during the same year.

Working capital Turnover ratio Net Sales Working Capital. It is calculated by adding total cash and equivalents accounts. 420000 60000.

Working capital is current assets minus current liabilities. 240000 140000 280000 1000002. As clearly evident Walmart has a negative Working capital turnover ratio of -299 times.

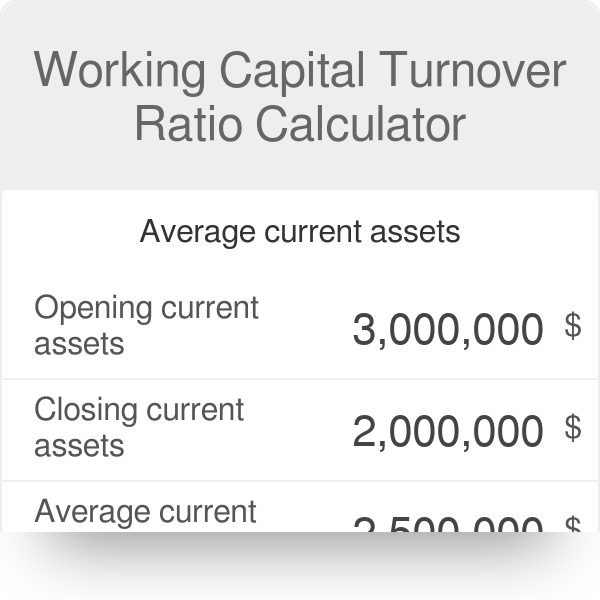

Working capital turnover ratio is an efficiency and activity ratio. The working capital turnover is preferred to be above 10 or at least equal to it. WC Turnover Ratio Revenue Average Working Capital.

Working capital turnover Net annual sales Working capital. Between 12 and 2. Working capital turnover ratio Net Sales Average working capital 514405 -17219 -299x.

15000050000 31 or 31 or 3 Times. Capital Turnover Ratio indicates the efficiency of the organization with which the capital employed is being utilized. Working Capital Turnover Ratio Net Annual Sales Working Capital.

Working Capital Current Assets - Current Liabilities. What is the Working Capital Turnover Ratio. Therefore a high turnover ratio indicates management is being very efficient in using its short.

For example if a company 10 million in sales for a calendar year 2 million in working capital its working capital turnover ratio would be 5 million 10 million net annual sales divided by 2. Working Capital Turnover Ratio Revenue Average Working Capital. A higher ratio is better since it represents a better utilization of working capital.

Generally a working capital ratio of less than one is taken as indicative of potential future liquidity problems while a ratio of 15 to two is interpreted as indicating a company on solid. The formula to measure the working capital turnover ratio is as follows. This shows that for every 1 unit of working capital employed the business generated 3 units of net sales.

This means that for every 1 spent on the business it is providing net sales of 7. What this means is that Walmart was able to generate Revenue in spite of having negative working capital. Say Company A had net sales of 750000 last year and working capital of 75000.

300000140000 214 Average working capital. The working capital turnover ratio is calculated as follows. What is the ideal working capital ratio.

Generally a working capital turnover ratio of 10 means that the company has generated sales of the same value as its working capital. A high capital turnover ratio indicates the capability of the organization to achieve maximum sales with minimum amount of capital employed. The funds 6 turnover ratio is a fraction of the 55 to 87 turnover.

The ideal quick ratio is considered to be 11 so that the firm is able to pay off all quick assets with no liquidity problems ie. Working Capital Turnover Ratio Net SalesWorking Capital. The working capital turnover ratio measures how well a company is utilizing its working capital to support a given level of sales.

The working capital turnover ratio. Formula to calculate. Average Working Capital equals working capital at the start of a period plus working capital at the end of the period divided by 2.

The complete information needed to calculate the average working capital is available from the beginningclosing balance sheets. This means that for every one dollar invested in working capital the company generates 2 in sales revenue. A business that sells a lot of low-cost items and cycles through its inventory rapidly such as a convenience store grocery store or discount retailer may only need a 111 110 working capital to 100 sales ratio of working capital per dollar of sales.

Working capital turnover ratio interpretation. Here the working capital formula is. Lets look at a couple working capital turnover ratio examples to bring some context as to why this metric is so useful for measuring efficiency.

Compute working capital turnover ratio of Exide from the above information. Working Capital Turnover Ratio Analysis.

Working Capital Turnover Ratios Universal Cpa Review

Working Capital Cycle Efinancemanagement

Working Capital Turnover Ratio Formula Calculator Excel Template

Working Capital Turnover Efinancemanagement Com

Working Capital Turnover Ratio Meaning Formula Calculation

Working Capital Turnover Ratio Meaning Formula Calculation

Asset Turnover Ratio Formula And Excel Calculator

Working Capital Turnover Ratio Meaning Formula Calculation

Activity Ratio Formula And Turnover Efficiency Metrics

Working Capital Turnover Ratio Formula Calculator Excel Template

Working Capital Ratio Analysis Example Of Working Capital Ratio

Working Capital Turnover Ratios Universal Cpa Review

Working Capital Turnover Ratio Ratio Interpretation Financial Ratio

Working Capital Turnover Ratio Meaning Formula Calculation

Stock Inventory Turnover Ratio Calculate Formula Benchmark

Working Capital Turnover Ratio Calculator

Days Working Capital Formula Calculate Example Investor S Analysis

Working Capital Turnover Ratio Formula Calculator Excel Template